Saving money is one of the significant aspects to be financially secured. Most of us learned the importance of saving money in different ways. But in case you wanted to teach your children the importance of saving money, here are six easy yet very effective ways.

Use A Piggy Bank

©mum central

Saving on a piggy bank is one of the easy ways to teach kids the importance of saving. The main objective here is to fill up the piggy bank with bills or even coins up until it if full. You can tell your kids that the money they save can be used for the future and that the more money they were able to save, the more it will grow.

Open A Bank Account

©ecloans.com

The moment the piggy bank is full, the next step would be opening a bank account. Allow them to count the amount of money they will be depositing, so that they know the exact amount of money they have saved. This way they can be motivated by the fact that their money will grow as long as they don’t touch it.

Use An Empty Jar In Saving

©insperelle.com

If your kids want something for themselves, you have to let them know that they have to save to be able to buy it. Give them a jar for each of the things they wanted to buy and offer them a small amount of allowance each week to encourage them to save. For instance, you can give your child five dollars a week. You must give it to in one dollar bills so that they can save all their money for just one purchase, or they can fund different jars to save for different goals

To encourage them more in saving up for their short-term aims, you can place a picture of the thing they wanted to buy. Doing so can give them a visual reminder of what they are saving to.

Create A Timeline

©couponsaregreat.net

It is really difficult to explain the concept of money to a kid so you have to be consistent about it. For instance, if your child receives a $50 check each year during their birthday, you must discuss with your kid about budgeting right before receiving the check.

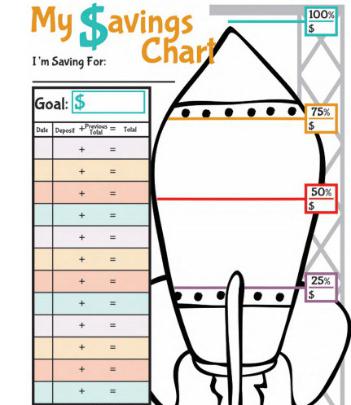

To be able to help them visualize their goal, you can make an illustration or chart of how much money is saved. Doing so can inspire them more and they will fully understand and they will feel how rewarding it is to save money. You can also give them a small reward once they have reached 25% of the chart, 50%, and 75% because this reward system can encourage your kids to continue saving.

Be An Example

©powerhomebiz.com

Most children learn by example and this is also applicable in saving money. As a matter of fact, the best way to teach your child about saving is by showing that you are saving is well. For example, you can have your own jar of money wherein you are placing your funds on a regular basis. In case you and your kids are going out for a shopping, you can show them how to distinguish between different prices and explicate why buying a certain item is more reasonable than the other. Aside from that, you can also tell them that every time you receive your salary, a portion of it is saved for future use.

Start A Conversation

Having a conversation about the importance of money and saving is a good way to start. You can use financial discussions to educate them more about saving money. Also, you can allow your children to know that they can have an allowance, but they will be the one to save for the things they want. On top of that, make an illustration of how much their money can grow as time passes by if they save.

It is also important for you to discuss the difference between needs and wants. Aside from that, you should tell your kid that they can also tell you some new ways on how to save. You can ask them about the things they wanted to save up for and what they want their future to be like.

Undoubtedly, teaching kids the ways to save money may seem to be a hard task. But despite that, through these tips, you can make your child’s learning about money enjoyable and accessible. Always remember, that this is an investment in knowledge which really recompenses the best interest.

Cover Photo Credits: Health Journal